The stock market just had its worst day since 2020. The Dow Jones, S&P 500, and Nasdaq all fell sharply. The reason? A new tariff announcement shook investors.

Tariffs make goods more expensive. Businesses pay more, and profits drop. That worries investors, so they sell stocks fast. This time, the sell-off was massive. Billions of dollars vanished in hours.

We have seen market crashes before, but this one felt different. It came when inflation was already a problem. People worry that higher costs will slow the economy.

Will the market bounce back, or is this just the beginning? Let’s find out some facts.

The Trigger: New Tariff Announcement

On April 2, 2025, President Donald Trump announced a sweeping tariff plan. A 10% tariff on all imports will take effect on April 5, with higher rates for countries with significant trade deficits starting on April 9. For example, imports from China will face a total tariff of 54%.

These tariffs target various sectors, including technology, manufacturing, and retail. Companies relying on international supply chains, especially those importing from China and Southeast Asia, are particularly affected.

Investors reacted swiftly. Fearing increased costs and reduced profits, they began selling off stocks, leading to a sharp market decline. This immediate response highlights concerns about the broader economic impact of the tariffs.

Market Impact: How Bad Was the Drop?

The stock market experienced a significant downturn:

- Dow Jones Industrial Average: Dropped 1,679 points (4%), closing at 40,546

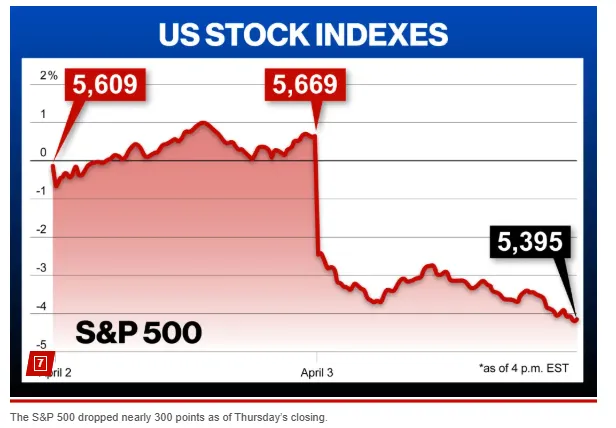

- S&P 500: Fell 4.8%, marking its worst day since 2020.

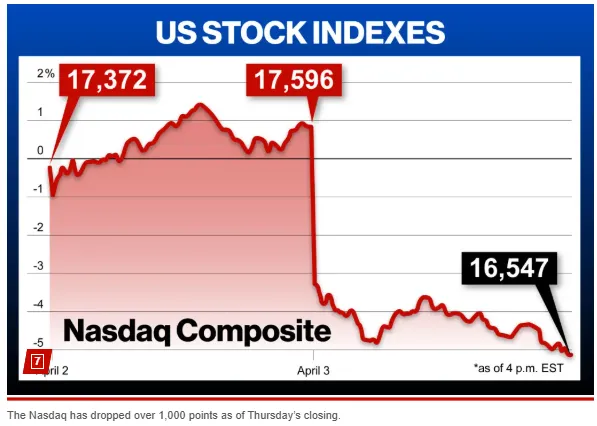

- Nasdaq Composite: Tumbled nearly 6%.

This sell-off erased approximately $3.1 trillion in market value. To put this in perspective, it’s one of the most severe declines since the 2020 pandemic-induced crash. The magnitude of this drop underscores the market’s sensitivity to trade policy changes.

Sector-Wise Breakdown: Who Lost the Most?

Certain sectors bore the brunt of the market decline:

- Technology: Apple’s stock fell over 8.5%, losing more than $250 billion in market value . Other tech giants like Amazon, Meta, and Nvidia also experienced significant losses.

- Manufacturing and Retail: Companies like Nike, heavily reliant on Chinese manufacturing, saw their shares drop more than 14%.

- Energy and Commodities: The tariffs led to concerns about global demand, causing declines in energy stocks and commodity prices.

These sector-specific impacts highlight the interconnected nature of global trade and the widespread effects of tariff implementations.

Investor Sentiment and Trading Volume Surge

The announcement led to panic selling, resulting in unusually high trading volumes. Both institutional investors and retail traders moved quickly to adjust their portfolios in response to the news.

The Cboe Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” spiked over 20%, reaching its highest level since August . This surge indicates heightened market anxiety and expectations of continued volatility.

Broader Economic Concerns

Economists are raising alarms about the potential for these tariffs to slow economic growth and increase inflation.

Deutsche Bank analysts warned that the tariffs could reduce U.S. GDP growth by 1 to 1.5 percentage points, significantly raising recession risks.

The Federal Reserve may face pressure to adjust monetary policy in response to these developments.

Internationally, global markets have also reacted negatively, with significant declines in European and Asian stock markets.

What’s Next? Market Recovery or Further Decline?

Analysts are divided on the market’s future trajectory. Some believe that if trade tensions escalate, we could see further declines. Key upcoming events include potential negotiations between the U.S. and its trading partners and any policy responses from the Federal Reserve. Investors will be closely monitoring these developments to gauge the market’s direction.

Final Thoughts

The recent tariff announcements have led to a significant market downturn, with widespread impacts across various sectors. The immediate effects are clear, but the long-term outcomes are still unknown. Investors should stay informed and consider diversifying their portfolios to mitigate potential risks.

Frequently Asked Questions (FAQs)

The stock market is falling due to new tariffs announced by President Trump. These tariffs have raised concerns about higher costs for businesses and potential economic slowdown.

Yes, tariffs can increase import costs which lead to higher prices for consumers and lower profits for companies. This often results in negative reactions from investors and market declines.

The American stock market is down because of fears that new tariffs will slow economic growth and reduce corporate earnings. Investors are selling their stocks in response.

A stock market future is a contract to buy or sell a stock index at a set price on a future date. It’s used to speculate or hedge against market movements.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

What brings you to Meyka?

Pick what interests you most and we will get you started.

I'm here to read news

Find more articles like this one

I'm here to research stocks

Ask our AI about any stock

I'm here to track my Portfolio

Get daily updates and alerts (coming March 2026)