Did you know the global AI stock market is expected to reach over $500 billion by 2027? That’s hugeand investors are paying close attention. AI is no longer just a tech trend. It’s becoming the brain behind businesses, tools, and everyday services we use.

As this shift happens, Wall Street is picking its favorite players. In Q2, three names stood out: Palantir (PLTR), Amazon (AMZN), and SoundHound AI (SOUN). Each one is using artificial intelligence in smart, unique ways. But which one is leading the race?

Let’s analyze what each company is doing with AI, how they performed in Q2, and what analysts think about their future. Whether you’re new to investing or just curious about AI stocks, we’ve got you covered.

Company Overview

We start by looking at Palantir (PLTR), Amazon (AMZN), and SoundHound AI (SOUN). Each uses AI in special ways.

Palantir focuses on analytics and data for governments and businesses. Its platforms, Foundry and Gotham, are powered by its proprietary AI, especially its Artificial Intelligence Platform (AIP). AIP helps users build useful tools using large language models and structured data; it’s called a competitor to NVIDIA’s CUDA in real-world use cases.

Amazon is best known for e‑commerce. But its cloud arm, AWS, is leading AI infrastructure. It offers services like Bedrock, Trainium, and custom AI tools. Amazon invests billions to improve automation and AI-trained systems for businesses and retail.

SoundHound AI is smaller but fast‑growing. It makes voice AI products like Houndify, Amelia, and Smart Ordering. Its tech runs in cars, restaurants, healthcare, and more. SoundHound supports many languages and holds over 250 patents.

Q2 Financial Highlights & Stock Performance

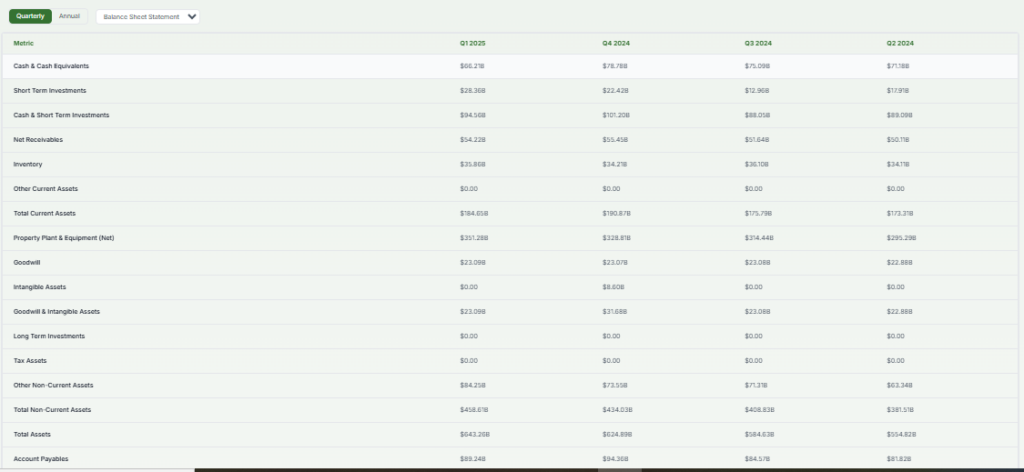

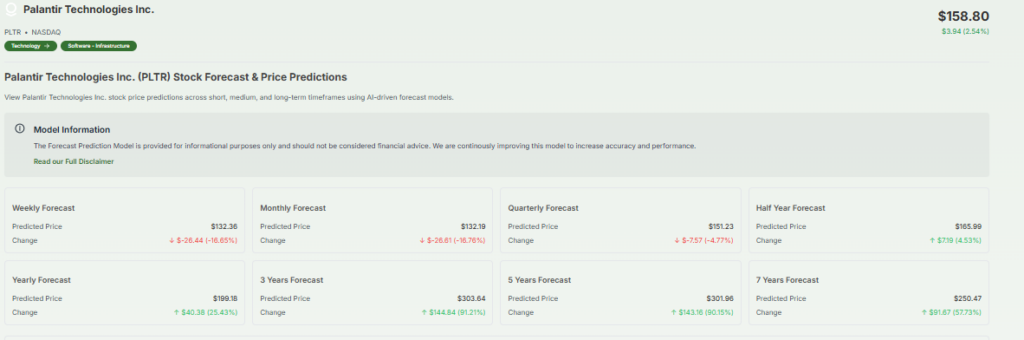

Palantir wrapped up Q1 2025 with strong numbers. Revenue rose 39% year‑over‑year to $884 million, and net income more than doubled to $214 million. The company then raised its full‑year revenue forecast to almost $3.9 billion. Wall Street expects Q2 revenue near $937 million and earnings per share at about $0.14. So far in 2025, Palantir stock is up over 97% or more than 110% per some sources.

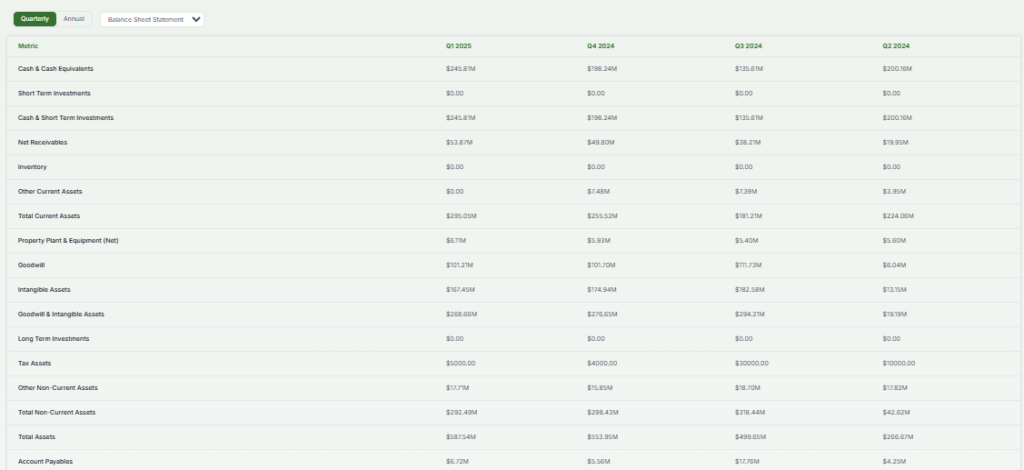

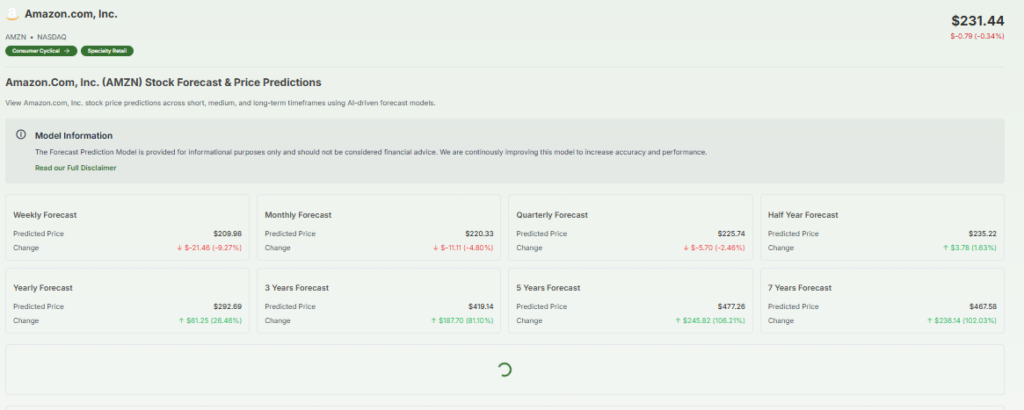

Amazon will report Q2 results on July 31. Analysts predict revenue near $162 billion, up about 9-9.5% year‑over‑year. EPS is expected to climb moderately by around 3-8%. AWS growth is a key driver: it grew 17% in Q1 and may accelerate as AI demand rises.

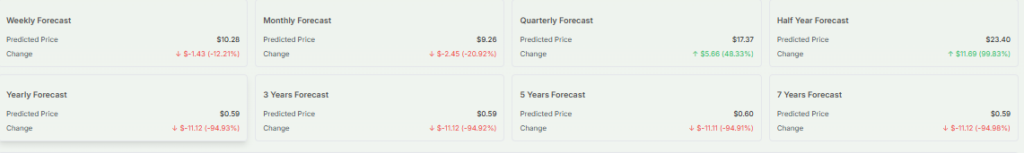

SoundHound AI will release Q2 results on August 7. In Q1, revenue hit $29.1 million, up 151% year‑over‑year. The company now serves about 200 enterprise clients and expects full‑year revenue between $155-175 million. Its stock has jumped about 94% in the past 12 months, far outpacing the S&P 500.

AI Strategy and Innovation Pipeline

Palantir’s growth is tied to its AIP platform. The company uses it to integrate AI workflows in the defense and private sectors. This platform helps solve real problems, such as healthcare monitoring and energy infrastructure planning. Rising U.S. government contracts 45% increase, and 71% growth in the U.S. commercial sectors boost its footprint.

Amazon relies on AWS to build its AI strength. As AI workloads grow, so does demand for cloud servers, chips like Trainium and NVIDIA GPUs, and foundational models. Part of its vast workforce may eventually be replaced by automation powered by AI, saving billions.

SoundHound focuses on voice AI. Its products power in‑car assistants in brands like Lucid, Stellantis cars, and Kia in India. It also runs voice ordering in restaurants, healthcare agents for patient enrollment, and in‑store smart devices. Its acquisition of Amelia AI in 2024 added strength in finance, insurance, healthcare, and retail AI sectors.

Institutional and Retail Sentiment

Analysts remain bullish on Palantir. Piper Sandler recently gave it an “Outperform” rating with a $170 price target. They see it as a long‑term winner in AI, even at a high valuation. Still, some analysts warn it trades at over 230× forward earnings, far above peers.

Amazon has strong analyst support with most ratings at “Buy” or “Strong Buy.” Price targets cluster around $251 on average, offering modest upside from current levels. Its reliable earnings and large scale make it a stable choice.

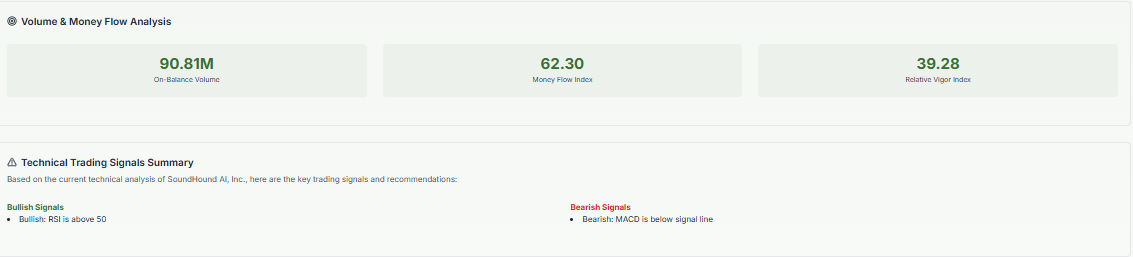

SoundHound draws attention from growth investors. Its rapid revenue growth and expanding partnerships create buzz. But its small size means it is volatile. Media spotlights often highlight its high growth, along with caution about overhype.

AI Stock: Risk Factors and Challenges

Palantir’s main risk is valuation. Even fans worry share price may pull back. Some top analysts forecast a possible 9% drop if growth slows. It also depends on government contracts, which can vary with political shifts.

Amazon’s risks include regulatory scrutiny, tariffs, and high investment costs. Labor savings from AI may take time. Rising import duties on Chinese goods could hurt margins later in Q3 or Q4.

SoundHound’s growth is strong but comes with volatility. Competition from tech giants like Google, Microsoft, and Amazon looms. It may need more cash to scale, and future dilution or funding risks remain.

Analyst Forecast & Long‑Term Outlook

Palantir’s forecast is strong. Piper Sandler sees over 30% annual growth and free cash flow margins above 40%, with a price target of $170. Long‑term, analysts expect a multi-billion-dollar run rate by 2032.

Amazon expects AWS to accelerate again in H2 2025 as hardware capacity catches up. Consensus lifted its 2031-33 EPS by more than 20% in recent weeks. Its scale makes it a more conservative choice with steady upside.

SoundHound projects full‑year revenue around $155-175 million, doubling from last year. Continued partnerships and product launches could send growth even higher. If execution stays smooth, upside could be large, but risk is high too.

Conclusion: Which AI Stock Leads?

Each stock has its angle. Palantir offers high growth and defense‑tech strength but trades at a steep valuation. Amazon is a stable giant with steady AI investments through AWS. It suits conservative investors. SoundHound AI is the wild card: eye‑catching growth but fragile size. Wall Street sentiment favors Palantir heading into Q2.

Analysts love its AI platform and contract wins. But for long‑term stability, Amazon feels safer. And for investors chasing explosive AI growth, SoundHound is the exciting but riskier pick.

Frequently Asked Questions (FAQ)

Top AI stocks to consider are Palantir, NVIDIA, and Amazon. They lead in AI tools, cloud computing, and data analytics. Each has strong growth in the AI market.

Palantir is growing fast in AI, especially with government and big business. It offers strong AI platforms, but some bigger companies still lead in global AI use.

There’s no single “best” AI for stock picking. Tools like ChatGPT, Trade Ideas, and FinBrain help investors, but results depend on research and strategy.

NVIDIA is often called the king of AI stocks. It makes powerful chips used in AI systems worldwide. But others like Amazon and Microsoft are strong too.

Disclaimer:

This is for information only, not financial advice. Always do your research.

What brings you to Meyka?

Pick what interests you most and we will get you started.

I'm here to read news

Find more articles like this one

I'm here to research stocks

Ask our AI about any stock

I'm here to track my Portfolio

Get daily updates and alerts (coming March 2026)