We begin with Greggs shares, a topic stirring interest across the stock market. In 2025, their value dropped almost 40%, catching many investors’ eyes. This piece explores whether that dip signals a rare chance to buy into a solid company at a low price.

Sales figures tell a strong story despite the fall. In the first half of 2025, like-for-like sales grew 2.6%, and total sales rose 6.9%, crossing £1 billion in 26 weeks.

Yet, hurdles like June’s hot weather and store upgrades have sparked concerns, pushing profit forecasts below last year’s mark.

How Greggs Shares Performed in 2025

We start with the numbers behind Greggs shares. Sales in the first half of the year reached £1 billion, up 6.9% from last year, with steady growth of 2.6% when comparing similar stores. That shows customers still love their baked goods, even with challenges.

But not everything went smoothly. June’s hot weather cut foot traffic, and store refurbishments slowed some locations. The company now expects full-year profit to dip slightly below 2024 levels.

Expansion stayed on track, though. Greggs added 87 new stores in the first half of 2025, expanding its footprint. This mix of growth and setbacks shapes the stock’s current story.

What Drove the 40% Drop in Greggs Shares?

Several forces hit Greggs shares hard this year. June’s hot weather kept people indoors, away from stores. Refurbishments also closed shops temporarily, hurting sales.

The stock market itself added pressure. Investors grew cautious as broader trends shifted, amplifying Greggs’ dip. Some see these as short-term issues, not deep flaws.

We note the stock’s valuation, too. At 13 times forecast earnings, it sits well below its five-year average of 28. This gap hints at a possible overreaction by the market.

Is This Drop a Bargain for Stock Market Investors?

We now ask if Greggs shares are a steal after falling 40%. The current price, 13 times forecast earnings, looks cheap compared to its past average of 28. Plus, a 3.9% dividend yield sweetens the deal for income seekers.

Consider these points:

- Sales grew 6.9% to £1 billion, showing strength.

- New shops, 87 so far, signal future gains.

- Weather and upgrades are temporary woes.

Still, risks linger. Profit may slip this year, and stock market swings could delay a rebound. We see potential here, but timing matters.

Breaking Down Greggs’ Strengths

We find plenty to like in Greggs’ core business. Its sales climbed to £1 billion in just 26 weeks, proving demand holds firm. That 2.6% like-for-like growth reflects loyal customers.

Expansion fuels optimism, too. Adding 87 new shops this year shows confidence in the brand. Each new spot could lift sales as the economy steadies.

The 3.9% dividend yield stands out. It offers steady returns, rare for a stock this discounted. We think these strengths balance out the current noise.

Comparing Greggs to the Stock Market

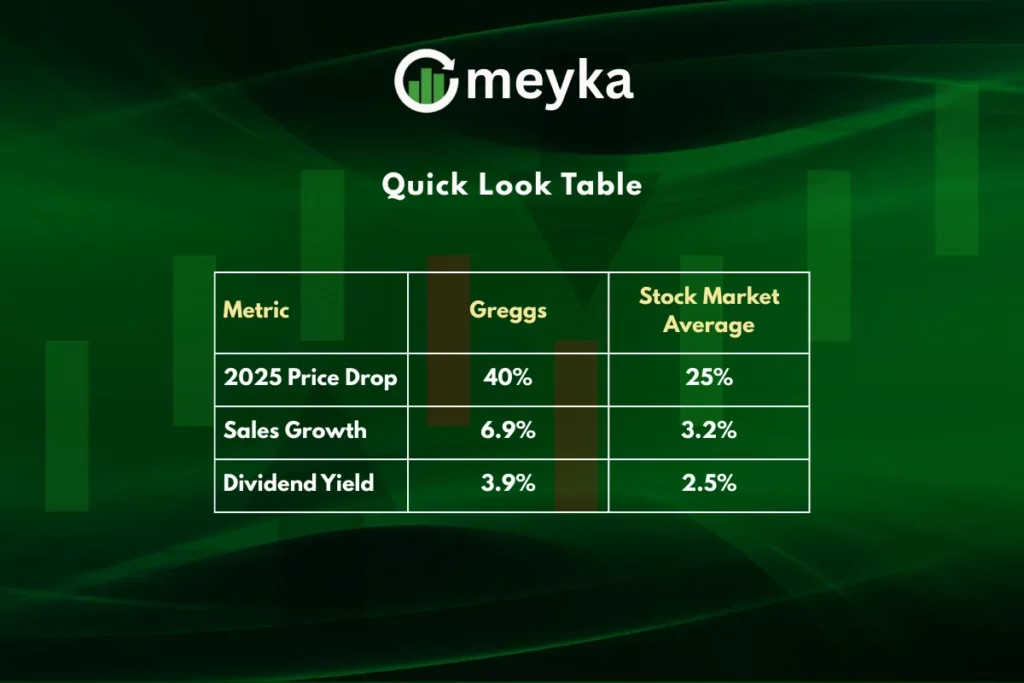

We put Greggs shares beside broader stock market trends. Many stocks faced volatility in 2025, not just Greggs. Its 40% drop mirrors some peers, but its sales growth stands apart.

Greggs beats the average in sales and yield. That edge could draw investors seeking value amid market dips.

Risks to Watch in Greggs Shares

We can’t ignore the downsides to Greggs shares. June’s hot weather hurt sales, and more odd weather could strike again. Refurbishments, while smart long-term, pinch profits now.

The stock market adds uncertainty. If wider trends sour, even strong firms like Greggs feel it. Profit forecasts below 2024 levels also raise eyebrows.

Valuation helps, but it’s not everything. At 13 times earnings, the stock looks cheap, yet recovery hinges on execution. We weigh these risks against the upside.

Final Thoughts on Greggs Shares

We wrap up with a clear take on Greggs shares. The 40% drop looks steep, but sales growth and new shops point to resilience. At 13 times earnings and a 3.9% yield, it might be a stock market gem.

Challenges like weather and profit forecasts temper the excitement. Still, we see a case for investors who can wait out the storm. This article does not give financial advice.

Disclaimer:

This content is for informational purposes only and not financial advice. Always conduct your research.

What brings you to Meyka?

Pick what interests you most and we will get you started.

I'm here to read news

Find more articles like this one

I'm here to research stocks

Ask our AI about any stock

I'm here to track my Portfolio

Get daily updates and alerts (coming March 2026)