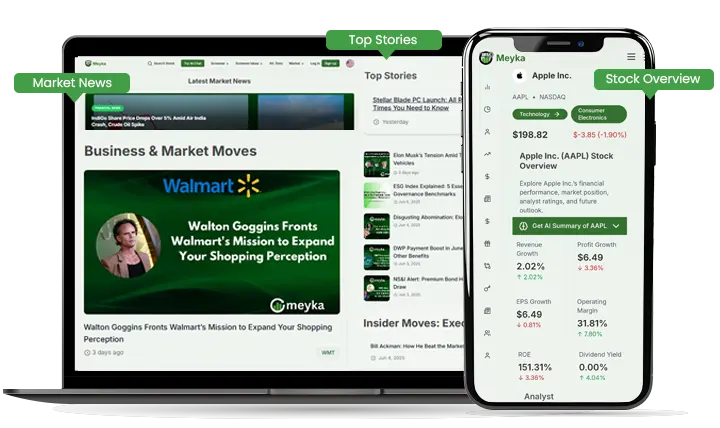

Next-Gen Alternative Data Platform for Investors

Meyka is the best Alternative Data platform powered by AI providing research insights for investors

Scroll for updates

Global Market Indices

Market Perspectives

No News Available

Check back later for updates about this stock.

Frequently Asked Questions

Smarter Investing Starts with MEYKA AI

Welcome to MEYKA AI, A fusion of intelligence and innovation in the world of investing. We are transforming how you analyze, research, and trade stocks by combining advanced machine learning with real-time market data. Whether you're an experienced trader or a beginner exploring your first portfolio, MEYKA AI provides AI stock analysis tools that empower you to make smarter, faster, and more confident decisions.

The Future of Stock Research is Here

Tired of outdated reports and slow-moving insights? MEYKA AI’s AI stock research engine gives you access to comprehensive and continuously updated analysis across global markets. Dive deep into companies’ financials, discover high ROE stocks, and get ahead of the curve with instant, data-backed insights. Our platform filters out the noise and brings clarity to your investments. It’s the best stock research platform built for precision and performance.

Real-Time Stock Research You Can Trust

The market doesn’t sleep, and neither does MEYKA. Our real-time stock research capabilities monitor thousands of data points around the clock, scanning for trends, risk signals, and opportunity zones. MEYKA AI dynamically updates stock ratings, financial ratios, news sentiment, and technical signals in real time, ensuring you’re always in sync with the markets.

Discover the Best Stock Picker Tool

Choosing the right stocks is no longer a guessing game. MEYKA AI is your best stock picker tool, engineered to find stocks with optimal fundamentals, technical strength, and future growth potential. Our AI stock screener uses deep learning to rank equities based on key metrics like stock ROE, EPS growth, price momentum, valuation multiples, and sector performance, giving you a list of winners tailored to your strategy.

Intelligent Backtesting for Strategic Advantage

Why rely on theory when you can validate with data? MEYKA AI’s strategy backtesting tool allows you to simulate any trading strategy across historical market data. Analyze performance, drawdowns, and volatility before committing your capital. Whether you're testing value investing, momentum plays, or dividend strategies, our platform helps you fine-tune your edge.

AI Stock Chatbot – Ask Anything, Anytime

Meet your AI-powered investing assistant. The MEYKA AI stock chatbot is your 24/7 research companion, ready to answer your stock-related queries in real time. From “What’s the current ROE of Tesla?” to “Show me undervalued tech stocks with strong fundamentals,” our intelligent chatbot has you covered, with data-backed, human-like responses that go beyond generic answers.

Stock ROE Analysis Simplified

MEYKA AI puts stock ROE (Return on Equity) at the heart of your financial evaluation. Identify companies generating efficient profits relative to shareholder equity and filter out the underperformers. We highlight high ROE stocks that signal strong capital efficiency and long-term potential, because quality matters when building a sustainable portfolio.

From Discovery to Execution – All in One

Why jump between tools when everything you need is in one place? MEYKA AI gives you a fully integrated environment for stock research, strategy testing, portfolio insights, and AI-driven alerts. Whether you’re investing for growth, income, or preservation, our platform adapts to your goals.

Why Investors Trust MEYKA AI

- AI Stock Analysis Engine with deep learning models trained on decades of financial data

- High-Performance Stock Screener to instantly find stocks matching your criteria

- Custom Alerts & Watchlists for real-time tracking and decisions

- Cross-device Access so you never miss an opportunity

- Dedicated AI Stock Chatbot that simplifies complex market data into plain English

Join the AI Stock Revolution with MEYKA

The future of intelligent investing is here — and it’s powered by MEYKA. Our platform makes institutional-grade tools available to everyone. With cutting-edge analytics, intuitive design, and a relentless focus on performance, MEYKA AI is not just another stock tool — it’s your investing co-pilot.

Get Started Today

Ready to take control of your financial future? Sign up for MEYKA AI and explore the full power of AI stock research. Whether you’re looking for the next breakout stock, backtesting your strategies, or analyzing stock ROE to find long-term winners, MEYKA AI is the trusted companion for every investor.